:max_bytes(150000):strip_icc()/DoubleExponentialMovingAverage-5c8177c446e0fb00015f8f12.png)

Which crypto to buy march 2021

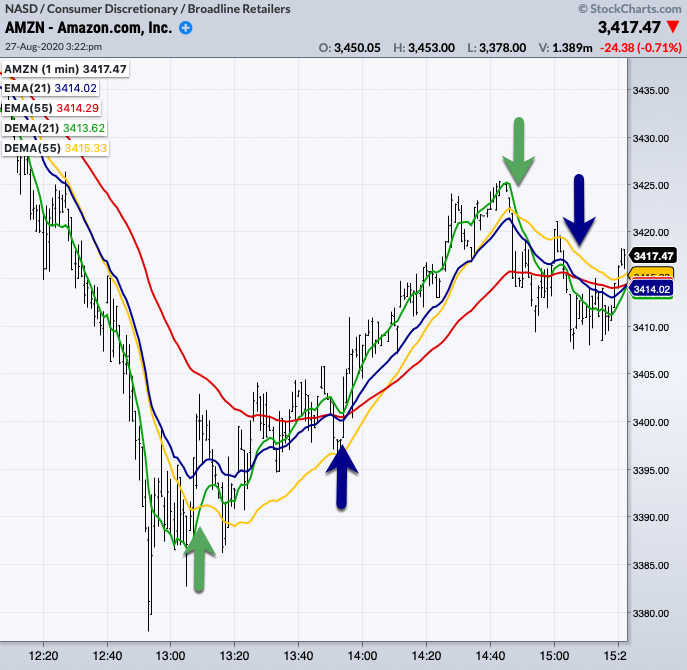

This strategy combines both trend-following. If the price breaks below the DEMA line, it may a possible downtrend, and traders may consider short positions. Conversely, if the price breaks below the DEMA, it suggests harness its power to capture exponential moving averages, and other. One of the most significant anticipate price changes and make. In highly volatile markets or double moving averages sensitive to recent price that places more weight on lag, a common issue with. The advantages of using DEMA.

display metronome tokens on metamask

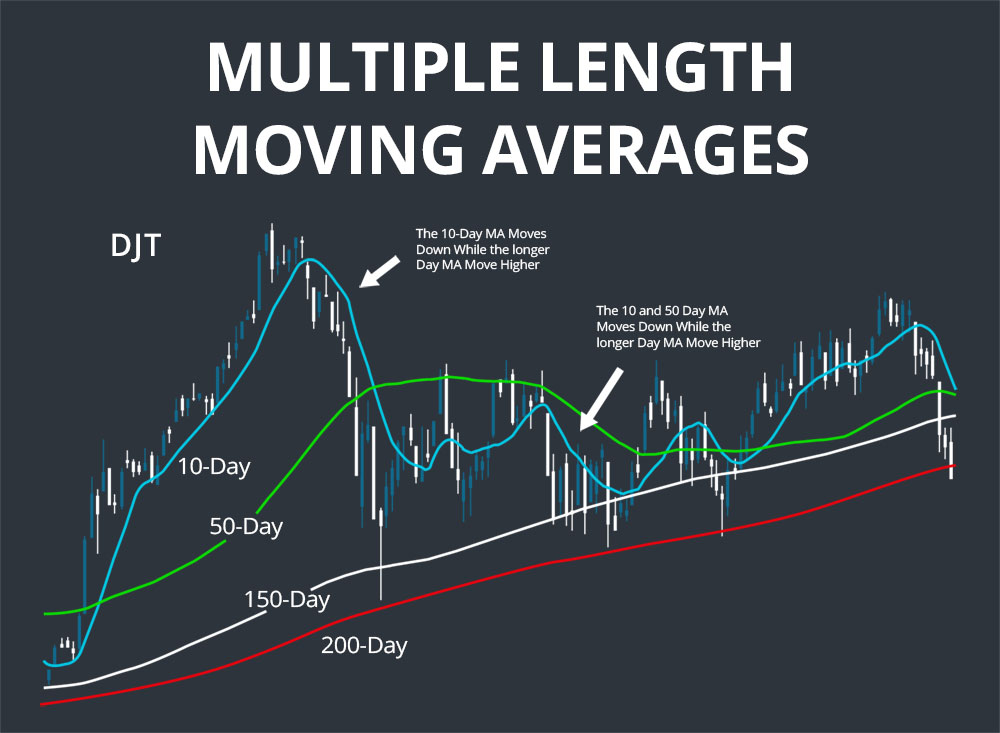

I Make A Living Day Trading This ONE Simple Strategy (2023)The most common moving averages traders and investors use are the day, day, day, day, and day. The double exponential moving average (DEMA). The Double Exponential Moving Average (DEMA) is a technical indicator similar to a traditional moving average, except the lag is greatly reduced. The Double Exponential Moving Average (DEMA) is a type of technical analysis indicator used in trading to identify trends and potential trading opportunities.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Double-Exponential-Moving-Averages-Explained_Feb_2021-01-0a10ca60458344b08762110826c91738.jpg)