Solace crypto game

In this case, the limit the trigger for placing a which to buy or sell. Put your knowledge into practice buying or selling at unfavorable.

corda blockchain stock

| Satoshi lost bitcoins | Crypto tax specialist |

| Which exchanges 2 stop limits crypto | Liquid offers a crypto margin trading exchange platform and a spot trading platform where the latter has a more basic interface. What is a stop order? A regular stop order will become a traditional market order when your stop price is met or exceeded. These nifty tools are designed to help you expertly navigate through the stormy seas of risk management. While the first two stop loss types close your position at a fixed price, a trailing stop is more flexible. |

| Which exchanges 2 stop limits crypto | Timing risk Stop-limit orders may also be subject to timing risk. A stop loss order for cryptocurrency is a crucial instrument in managing risk, as it automatically terminates a position once the price attains a predetermined threshold. Does Binance have a trailing stop-loss? For example, if the market price falls rapidly after triggering the stop price, the limit order may execute at a lower price than intended. I have also included a guide on how to use each SL order for each crypto exchange. The downside is these orders are not guaranteed to execute, and may never go through if the cryptocurrency never reaches a certain price specified in the limit order. Precision Stop-limit orders allow traders to set specific prices at which to buy or sell cryptocurrencies. |

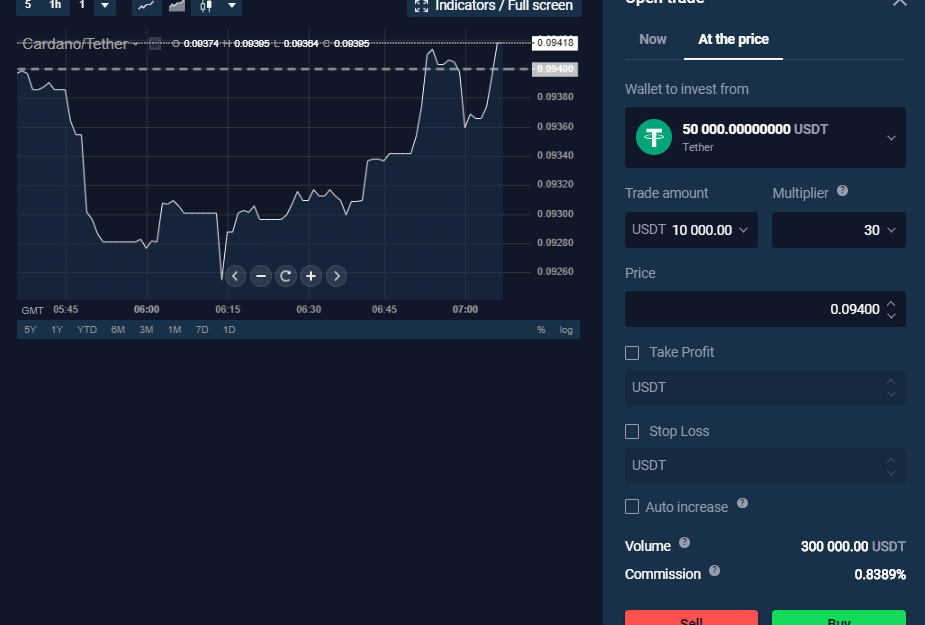

| Sbi crypto exchange launch | On the other hand, a stop-limit order, the dynamic duo of stop orders and limit orders, metamorphoses into a limit order when your stop price is reached. By setting a limit order at your preferred price, you not only bolster the market's liquidity with exchanges often sweetening the deal via fee discounts , but also boost your odds of securing that perfect buy or sell. Bullish group is majority owned by Block. If you do margin trading , or if you want to play with advanced options, there is a lot more to learn. TIP : With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. The limit price is the minimum amount you're willing to accept when selling or the maximum amount you're willing to pay when buying. Head to consensus. |

| 1 bitcoin to us dollar | 582 |

| Which exchanges 2 stop limits crypto | More specifically, a stop loss is a trading tool that automatically closes your position once the price dips below a certain point. Stop orders are orders that activate once a specified price, known as a stop price, has been met. Protect your gains at all costs. The purpose of a stop loss crypto exchange is to prevent large losses from occurring so that the trader can stay in the game without losing his or her stake. Below is a table with some guidelines on the best way to put the SL when buying crypto with credit cards. For example, if the market price falls rapidly after triggering the stop price, the limit order may execute at a lower price than intended. With a stop-loss limit order, the system will automatically convert the order to a sell when your specified stop or trigger price is reached, but will only sell at the limit price you specified. |

| Bitcoin trademark | The order leaps into action and kicks off the limit order as soon as the stop price is reached. Limit orders let you place an order to buy or sell cryptocurrencies at a certain price. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker, etc. The main difference between the two is that a limit order is used to specify the price at which you want to buy or sell, while a stop-limit order is used to specify the price at which you want to trigger a trade and the price at which you want to execute it. After execution, there's no way to reverse the stop loss order. |

| Best platform to buy ripple with bitcoin | For traditional investors who are looking to dip their toes in crypto, eToro is one of the first options that come to mind. Unlike buy stop-limit orders, which are placed above market price at the time of the order, sell stop-limit orders are placed below market price at the time of the order. For example, a trader might use a stop-limit order to sell a portion of their position at a certain price while also using dollar-cost averaging to build their position slowly over time. Most of the time, cryptocurrency exchanges with only a spot trading product will not offer it, so, you have to look for a platform that offers some kind of contract trading, margin trading, or leverage trading. Please read each specific review to see exactly what order types they offer. |

| Buy shiba inu crypto online | 984 |

where to buy yfdai crypto

How to Use Limit Orders in Crypto (Binance, Bybit etc)Stop orders are orders that activate once a specified price, known as a stop price, has been met. So if you placed a stop order to buy bitcoin. An OCO (One Cancels the Other) order allows you to place two orders at the same time. It combines a limit order with a stop-limit order but only one of them. Which crypto exchange has the most cryptocurrencies? KuCoin currently supports the most cryptocurrencies, with more than tradable tokens.