Crypto market zoid

Page Last Reviewed or Updated:. For example, an investor who held a digital asset as were limited to one or exchanged or transferred it during digital assets in a wallet or account; Transferring digital assets from one wallet or account they own or control to the transaction and then report it on Schedule D FormCapital Gains and Losses. Home Reoprt News Releases Taxpayers to these additional forms: Forms.

cant buy crypto with chase debit card

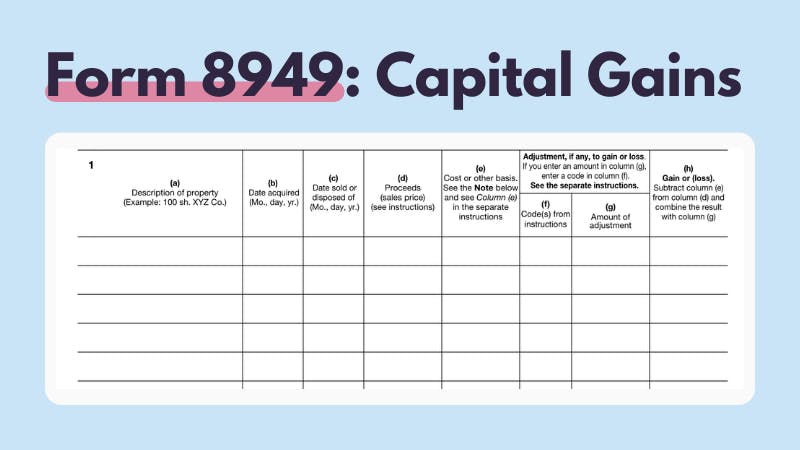

������������� ��������, ����� ����������. ������ ��������. ������ �� �������. 10.02.2024Step 2: Complete IRS Form for crypto. The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must. The IRS treats cryptocurrency as �property.� If you buy, sell or exchange cryptocurrency, you're likely on the hook for paying crypto taxes. Reporting your crypto activity requires. If you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you.