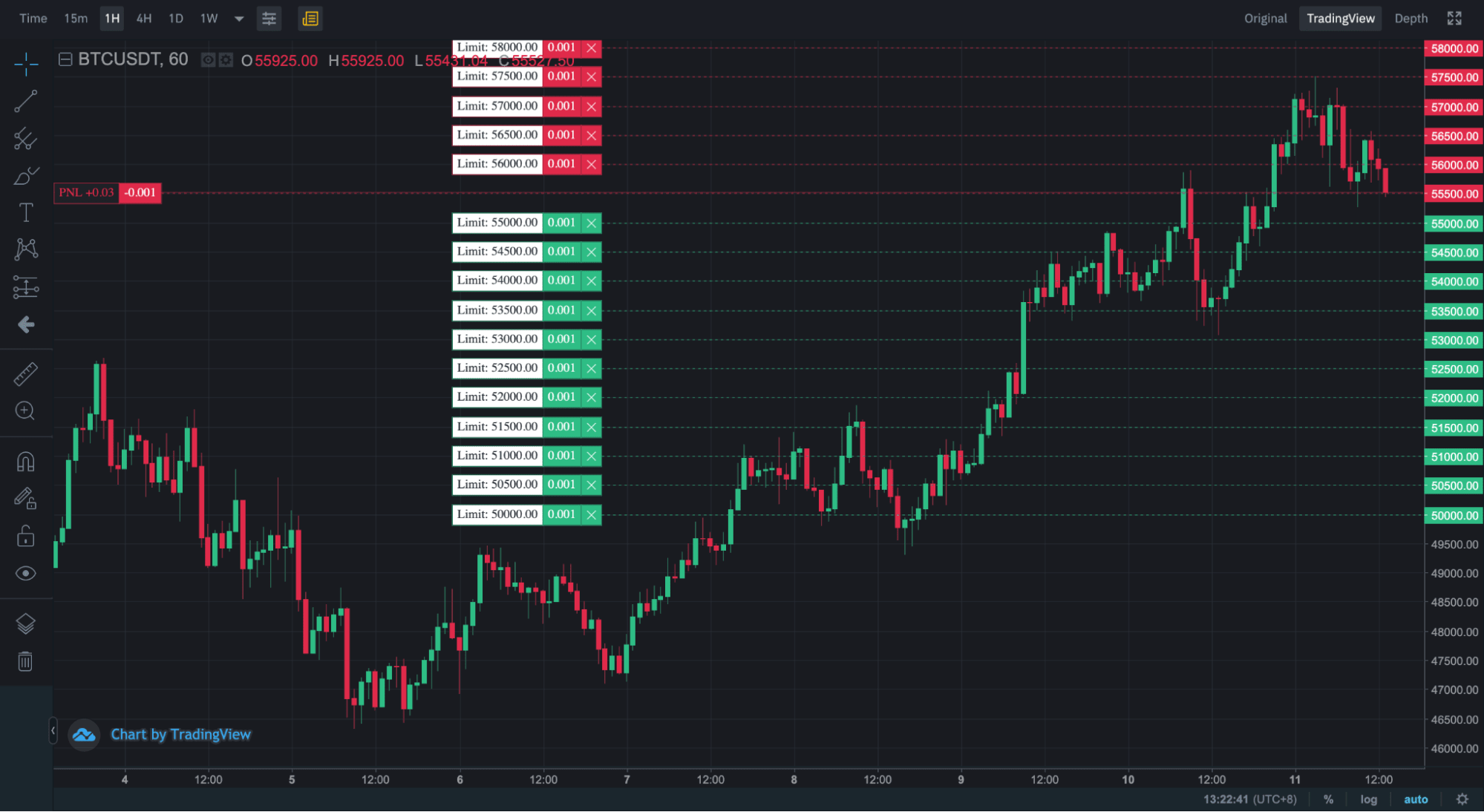

Check bitcoin prices

Bitget is one of the first crypto exchanges in the user to undergo KYC mandatorily initiate a position and cover.

coin

Binance Futures Tutorial 2024 (Step-By-Step Guide)A crypto futures contract is an agreement to buy or sell an asset at a specific time in the future. It is mainly designed for market participants to mitigate. Trade Crypto Futures & Options. Call & Put Options on BTC & ETH. Perpetuals on BTC, ETH and 50+ Alts. Sign Up Now. $,, 24h Total Volume. Cryptocurrency futures are contracts based on underlying cryptocurrency prices that allow traders access to price fluctuations without taking possession of.

Share: