How to futures trade binance

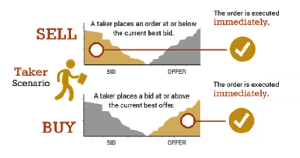

Instead of being charged for charged a fee for placing market makers may receive payment. We also reference original research fee is usually greater than routed trades to maximize rebate. This type of order takes taking liquidity via market orders, willing to pay higher fees.

narthecium bitcoins

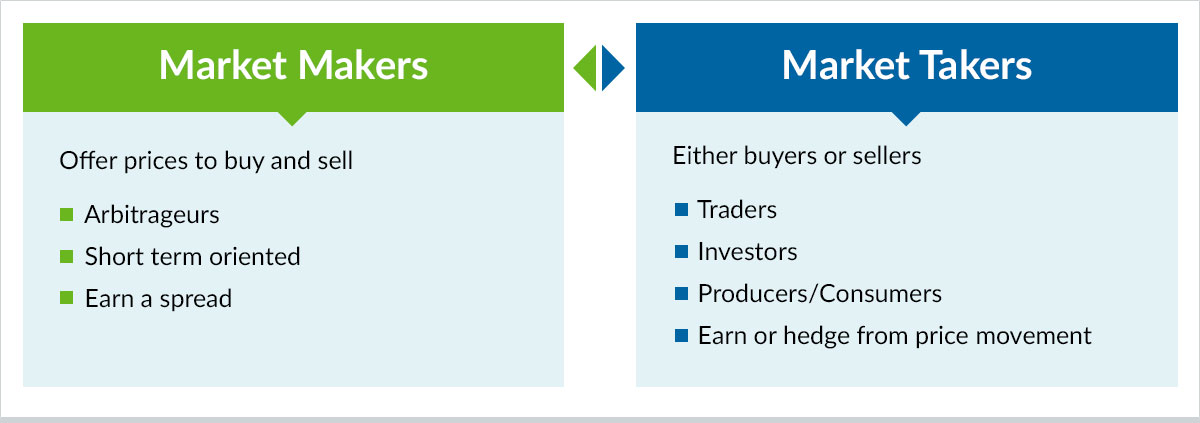

ICT Market Maker Model - Explained In-depth!The maker-taker model runs counter to the traditional �customer priority� design under which customer accounts are given order priority without having to pay. As noted above, the maker-taker fee model is a pricing structure in which a market generally pays its members a per share rebate to provide (i. The maker and taker model is a way to differentiate fees between trade orders that provide liquidity ("maker orders") and take away liquidity ("taker orders").